What Should Be The First Step In The Writing Process

You are here: Home / Bank Guides / How To Write A Check: Step by Step Instruction

Checks might not be a prominent or popular way to send money or make a payment, but you might be surprised how often checks are are still used today. Writing checks may be deemed to be an "ancient" practice especially with our current technology of online banking, direct deposits or ACH transactions, and payment apps such as Chase Pay.

In the event that you do, for some reason or another, lose access to these virtual forms of payments, checks are a great alternative. It is useful to know how to write a check even if you do not primarily use them. Whether you rarely write checks or never written one at all, below is a step-by-step instruction on How To Write A Check.

| | |

| Citi Priority Account Up to $1,500 Cash Bonus with required activities. | Wells Fargo Everyday Checking $200 Bonus with qualifying direct deposits Member FDIC. |

| HSBC Premier Checking $450 Bonus | Discover Bank Online Savings $200 Bonus |

| Chase Total Checking® $225 Bonus | Chase Business Complete BankingSM $300 Bonus |

| Huntington 25 Checking $300 Bonus | Huntington Business Checking 100 $100 Bonus |

| Huntington Unlimited Business Checking $400 Bonus | Huntington Unlimited Plus Business Checking $750 Bonus |

| TD Bank Beyond Checking $300 Bonus | TD Bank Convenience Checking $150 Bonus |

| Chase Secure BankingSM $100 Bonus | Aspiration Spend & Save Account $150 Bonus |

| Axos Bank Business Checking $100 Bonus | Axos Bank Rewards Checking $100 Bonus |

| TradeStation Up To $5,000 Bonus | Ally Invest Up To $3,000 Bonus |

| WeBull 2 Free Stocks | BlockFi Up To $250 BTC Bonus |

| SoFi Money $100 Bonus | Discover Bank $360 Cashback Debit |

The Check Basics

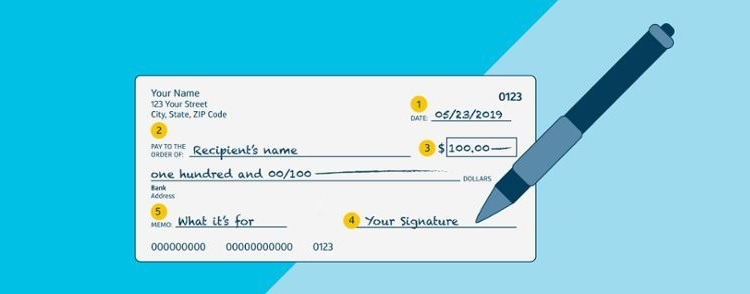

Depending on your bank, you check may vary based on their standard designs or if you chose to opt for one of their creative designs. If you are a current Chase customer, you may be interested in the Chase Check Writing Process. Generally, checks will have the same format as listed above.

You should familiarize yourself with the basic composition of the check and be aware of the numbers listed on the bottom. The first 9 numbers is your routing number, the number that identifies your bank, to the right of that is your bank account number, and the last few numbers to the check number. Any blank spaces on the check is what you would fill out.

Here's what you'll need to include when you write a check:

- Thedate

- Thenameof the person or company you're paying

- The payment amount in numbers

- The payment amount in words

- Yoursignature

- An optionalmemo, noting the reason for payment

Date Pay to the Order Of Write the Amount of Cash Signature Memo (Optional)

First and foremost, you would fill out the date on the check. Make sure to fill out the complete year either in numbers or fully written out. 01/01/2018 or January 1, 2018. You can either post the current date that you are writing the check or write a later date, which is known as a postdated check.

May people may postdate a check to allow the payee to wait to receive the funds or the payer does not have the current fund but will at a later date. Just be aware that postdated checks are not illegal as it isn't really an act of fraud.

If you notice the line listed as "Pay to the Order of", this is where you would write the recipient's or organization you are paying to. For security reasons, it is best to know who you are making the check to. Avoid writing "Cash" at all costs, even if you aren't sure what to write. Writing "Cash" on the "Pay to the Order of" line means that the check can be cashed for funds or anyone can deposit the check.

It may sound convenient, but just hearing that anyone can easily have access to your money is a bit risky. Banks are often hesitant to accepts checks payable to "Cash" also so it may be best to avoid it all together. Directly write the official name of who you are paying to to ensure that the payment goes through.

The dollar sign followed by a small box next to the recipient names is where you would write the dollar amount you owe in numeric form. And below the "Pay to the Order of" line is the line where you would write out the full dollar amount including cents in written form. Writing out the amount is to avoid fraud or confusion.

You can also add a cap to the written amount so the recipient is unable to add more funds to the check. For example if your amount is $250, on the written line you would write "Two hundred fifty and 00/100" or "Two hundred and fifty even." Make sure to write your cents in fraction form over 100, for example for 25 cents you would write 25/100.

Last but not least, sign the check. Sign clearly and legibly on the line in the bottom right corner of the check. Make sure to use the signature that is on file at your bank.

This is a crucial step as the check will not be valid without a signature. If you happen to decide to void the check payment, Chase offers an easy way for you to Stop Payment for a Chase Check.

The line in the bottom left corner above the routing number is the "Memo" line and is listed as "For". This line is optional and can be used as a little note to remind yourself what the check was used for.

You can use this line as a means to provide information that the recipient may use to process you payment, such as writing your account number for utility bill payments. You don't need to worry too much about it because whether you write or not write on the "For" line, it does not affect the way the bank processes checks.

After Check Writing

Now that you know the basics of check writing, what should you do after writing the check? It may be best to record every check you write to keep track of them and to prevent you from spending any funds twice. The funds will still show as available in your account until the check has been deposited or cashed, so it is best to keep note of the payment as it may take a while to process.

Being a check writing pro, you may be interested in writing Cashier's Checks or even Money Orders. Ran out of checks? Chase customers can easily Order Checks from Chase via online, a vendor site, or even by phone!

Check Writing Safety Tips and Takeaways

Check fraud doesn't just happen for certified checks, they are present in any instance when checks are being dealt with. Some types of fraud include forging or endorsing checks that belong to someone else, using chemicals to remove information from a check and stealing or counterfeiting checks that do not belong to you.

Use these tips to help you avoid being a fraud victim:

- Use pigment-ink pens to write checks.

- Fill out the entire check before signing it (no blank checks).

- Order carbon copy or duplicate checks.

- Keep your signature consistent.

- Find out if you can use a more secure form of payment.

Bottom Line

Given that you follow these instructions, you shouldn't have any trouble writing a check. Paper checks are an effective and inexpensive way to send money, so it may be essential for you to know how to write a check especially if you are unable to access your funds electronically.

It may be an "uncommon" way to send money, but there is a reason why it is still a reliable form of payment today!

To begin your check writing experience, you may want to find a bank that best works for you. If you are interested in current bank promotions in your area, check out our list of the Best Bank Bonuses to find the best one for you!

| See our best bank bonuses updated daily to earn up to $1,000 in free money. Find popular checking offers such as Chase Bank, HSBC Bank, TD Bank, Huntington Bank, Axos Bank, Discover Bank, Wells Fargo, and PNC Bank. See our best rates for Savings and CD. | ||

| | ||

| PROMOTIONAL LINK | OFFER | REVIEW |

| Wells Fargo Everyday Checking | $200 Bonus | Review |

| Discover Online Savings Account | $200 Cash | Review |

| Chase Business Complete BankingSM | $300 Cash | Review |

| Citi Priority Account | Up to $1,500 Cash Bonus with required activities. | Review |

| HSBC Premier Checking Member FDIC | $450 Cash | Review |

| Chase Total Checking® | $225 Cash | Review |

| Chase Secure BankingSM | $100 Cash | Review |

| Huntington 25 Checking | $300 Cash | Review |

| TD Bank Beyond Checking | $300 Cash | Review |

| TD Bank Convenience CheckingSM | $150 Cash | Review |

| Discover Cashback Debit Account | $360 Cash | Review |

| Huntington Bank Unlimited Plus Business Checking | $750 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

| SoFi Money | $100 Cash | Review |

| PNC Bank Virtual Wallet | Up to $300 Cash | Review |

| PNC Bank Virtual Wallet Pro | Up to $200 Cash | Review |

| BMO Harris Smart Advantage Account | $200 Cash | Review |

| Aspiration Spend & Save Account | $150 Cash | Review |

| Axos Bank Rewards Checking | $100 Cash | Review |

| Axos Bank Basic Business Checking | $100 Cash | Review |

| Acorns Spend Checking | $75 Cash | Review |

| TradeStation | Up to $5,000 Cash | Review |

| Ally Invest | Up to $3,000 Cash | Review |

| American Express High Yield Savings | 0.40% APY | Review |

| BlockFi | Up To $250 BTC | Review |

| Voyager (code ANTJZL) | $25 In BTC | Review |

| Coinbase | $10 In BTC | Review |

What Should Be The First Step In The Writing Process

Source: https://www.hustlermoneyblog.com/how-to-write-a-check/

Posted by: ogrentherong.blogspot.com

0 Response to "What Should Be The First Step In The Writing Process"

Post a Comment